Although the foreign exchange market can be challenging, it is highly appealing to numerous individuals due to its extensive financial transactions, which allow traders to generate substantial earnings.

Nevertheless, both small and large participants frequently seek to obtain more prominent positions to take advantage of leverage, resulting in the phenomenon known as liquidity grab. In this article, we will explore the concept of liquidity acquisition and its associated hazards and discover strategies to avoid it.

Definition of the Liquidity Grab

Let’s begin by delving into the definition of liquidity grab, and then we can examine the concept of liquidity in the financial market.

Liquidity refers to the ease of buying or selling an asset or security without significantly impacting its price. Ample liquidity facilitates substantial transactions without causing any noteworthy fluctuations in prices, thereby fostering stability in prices. A market with high liquidity is characterized by a large number of buyers and sellers, which facilitates trade execution. On the other hand, a market with low liquidity has a limited number of buyers and sellers.

On the flip side, a lack of liquidity can make prices more susceptible to fluctuations, which can have a significant impact on trading strategies and decisions. During periods of limited liquidity, substantial transactions have the potential to disturb the equilibrium between supply and demand, resulting in swift fluctuations in prices.

Now that you understand liquidity, we can discuss the concept of a liquidity grab in trading.

A liquidity grab refers to an abrupt and intense movement in the foreign exchange market caused by a sudden surge in trading activity. Notable fluctuations in prices typically accompany this surge. These spikes usually occur due to the sudden increase in purchase or sale requests, which affects specific transactions and the overall stability of the financial market.

Throughout history, financial markets have been significantly influenced by liquidity grabs, from the 1929 Wall Street Crash to the 2008 Global Financial Crisis. These events have continuously adapted to market dynamics and financial instruments, leaving a lasting impact on economic landscapes.

There may be a liquidity squeeze when there is an unexpected spike in demand for a particular currency pair. This can lead to an increase in trading activity as well as a significant price movement of the currency pair. This typically takes place as a consequence of news events, the publication of economic data, or movements in market mood, all of which have a considerable influence on the pricing of financial assets.

Liquidity grabs may either benefit or harm traders, depending on their position in the market. Traders who have entered the market before the liquidity grab are in a position to capitalize on price variations. Traders who have yet to enter the market prior to the liquidity grab may suffer significant losses, particularly if they enter the market without having made any prior investments.

Recognizing the Signs of a Liquidity Grab

In the world of FX trading, it can sometimes be challenging to differentiate between liquidity grab and other market occurrences such as a break of structure or liquidity sweep. Nevertheless, several notable characteristics can assist you in differentiating liquidity grab from different market conditions.

- Liquidity snatch occurs rapidly and is frequently initiated by substantial market orders that simultaneously activate multiple stop-loss orders.

- It happens unexpectedly and at a rapid pace.

- When it comes to liquidity grabs, significant traders or institutions usually drive the trend.

- These types of acquisitions typically lead to short-term price fluctuations rather than lasting shifts in market patterns.

- Charts often reveal liquidity grabs through distinct candle patterns observed on shorter time frames.

Steps to Take to Prevent Liquidity Grabs

In order to safeguard their positions from potential liquidity grabs, traders must have a comprehensive understanding of the associated risks and implement appropriate measures to mitigate them. Here are some steps you can take to protect your assets.

Keep an Eye on Fluctuations in the Market

Traders need to monitor market volatility across different timeframes and stay informed about important events, such as central bank announcements and political developments, that can impact currency values and trigger sudden shifts in liquidity.

Examining technical, fundamental, and economic indicators can help recognize possible risks and adjust positions promptly to prevent unforeseen price fluctuations.

Consider Utilizing Stop-Loss Orders

Stop-loss orders play a vital role in foreign exchange trading, helping to manage and mitigate risk effectively. They establish a pre-determined price level to close a trade automatically, thereby minimizing the possibility of incurring losses.

When placing these orders, traders need to assess their comfort with risk, establish the order at the selected price level, and monitor the market closely to make any necessary adjustments.

Stay Informed About the Latest News and Global Events

Achieving success in trading necessitates the continuous monitoring of external factors, such as news events, central bank announcements, or political occurrences. These occurrences have the potential to result in significant changes in prices and an increase in trading volume, highlighting the importance of traders exercising caution and making informed choices.

To plan their trading strategies effectively, traders need to stay informed about news from multiple sources.

Steer Clear of Trading During Non-peak Hours

Engaging in foreign exchange trading outside of regular market hours carries a certain level of risk, primarily due to reduced trading activity and broader spreads between buying and selling prices. These factors can result in slippage and prices that may not accurately reflect the current market conditions. To prevent this, traders should strategize their trading around periods of abundant liquidity, usually during the convergence of two trading sessions.

Swiftly finalizing transactions can help safeguard funds in the event of sudden liquidity demands. Furthermore, it is crucial to maintain composure during a liquidity squeeze, as fear and anxiety are not effective trading tactics.

If you find yourself trapped in a liquidity squeeze, here are some steps you can take to address the situation.

When faced with a liquidity grab, it is essential to follow a set of fundamental steps:

- Remain composed.

- Keep an eye on the market.

- Establish stop-loss orders.

- Manually close your trades.

- Assess your trading approach.

It is maintaining a calm and composed demeanor while trading is essential to prevent impulsive decision-making. This will help you stay focused and determined instead of getting overwhelmed when a sudden demand for cash occurs. It will also assist you in making logical and well-informed choices.

When confronted with a liquidity squeeze, it is imperative to close your trades promptly. Failing to do so may lead to significant losses or the chance to capitalize on potential profits slipping away.

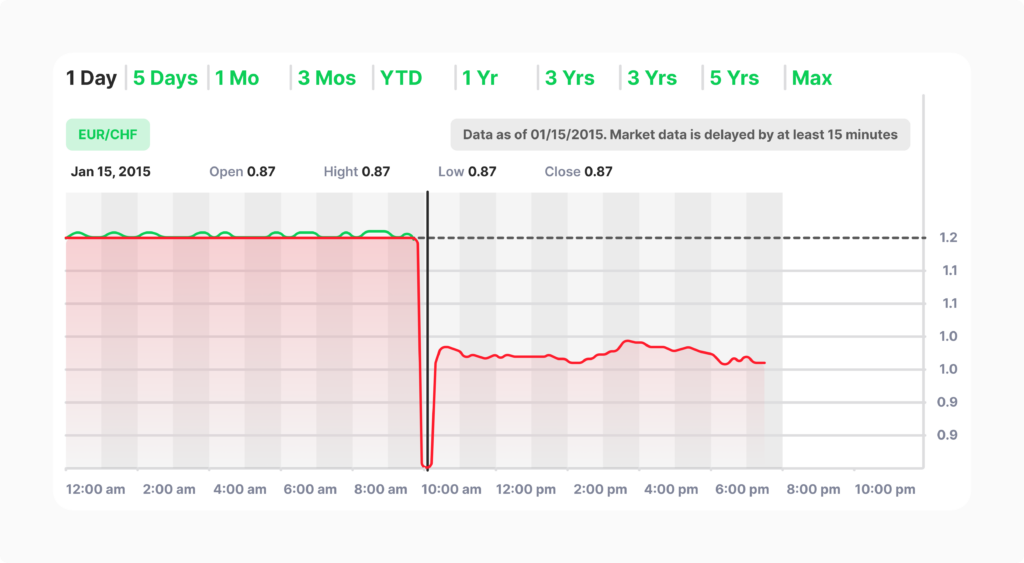

Every instance of liquidity grab is distinct, varying based on factors like market volatility or news events, making it crucial to be prepared for them. As an illustration, in 2015, following China’s decision to devalue its currency, investors were gripped by panic, resulting in a simultaneous closure of numerous trades by traders. The intense market frenzy resulted in a staggering amount of 800 million dollars in damages in a matter of minutes.

Gaining insights from previous encounters is crucial, as it enables traders to adjust their approaches and ready themselves for possible market occurrences. Examining trades to uncover trends and elements that influence the occurrence and utilizing tools such as learning opportunities or guidance can enhance trading tactics and risk control methods.

Concluding Remarks

In the Forex market, the presence of abundant liquidity can make trading more challenging and result in swift fluctuations in prices. This could lead to challenges in trading and result in more considerable disparities between buying and selling prices.

Traders have the option to employ a wide range of strategies to minimize their risk. They can utilize different approaches, keep a close eye on market price fluctuations, conduct thorough fundamental analysis, and use stop-loss orders to determine the best timing for entering or exiting trades and predicting market movements.

It is crucial to remain composed and practice self-control while trading to prevent financial losses.