To optimize one’s proficiency as a trader, one must comprehensively comprehend the overall sensitivity of one’s portfolio to fluctuations in market volatility. This phenomenon is especially evident in the context of forex trading. Due to the interdependence of currencies, it is essential to acknowledge that no individual currency pair trades in complete isolation from the broader market. Upon acquiring knowledge of these correlations and their dynamic nature, one can effectively utilize them to manage the overall exposure of their portfolio.

The Concept of Correlation

Trading the British pound against the Japanese yen (GBP/JPY pair) is a derivative of trading the pound against the dollar (GBP/USD pair) or the dollar against the yen (USD/JPY pair), and this is a clear example of how currency pairings are intertwined. Consequently, GBP/JPY exhibits a certain degree of correlation with either one or both of these currencies above pairs. The interdependence observed among currencies is derived from factors beyond the mere existence of currency pairs. While specific currency pairs may exhibit a positive correlation, others may demonstrate a negative correlation, reflecting the influence of intricate underlying factors.

Correlation, within the realm of finance, is a statistical metric utilized to assess the association between two distinct securities. A variety of values, from -1.0 to +1.0, may be seen in the correlation index. A correlation coefficient +1 indicates a perfect positive relationship between the two currency pairs, suggesting that their movements will consistently align in the same direction. A correlation coefficient of -1 indicates a perfect negative relationship between the two currency pairs, implying that their actions will always occur in opposite directions. A correlation value of 0 shows a lack of any observable link between the currency pairings, indicating a condition of pure randomness.

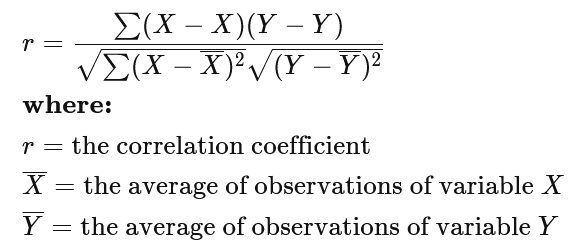

The equation for correlation is as follows:

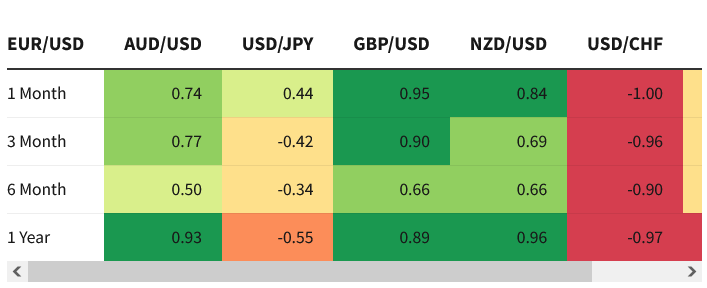

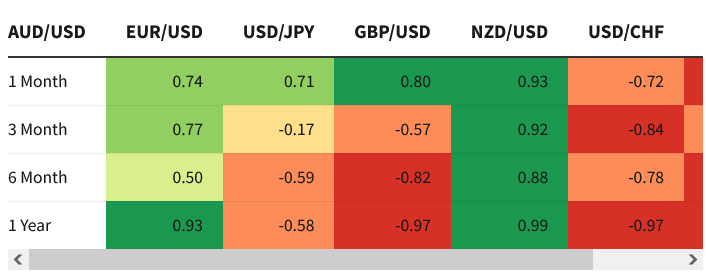

Analyzing the Data in the Correlation Table

Given the aforementioned understanding of correlations, let us now direct our attention towards the ensuing tables, which present correlations pertaining to the principal currency pairs. These correlations have been derived from real-time trading activities within the forex markets in the recent past.

Table of Correlations for EUR/USD

Table of Correlations for the AUD/USD

The table above shows a notable positive correlation of 0.95 between the EUR/USD and GBP/USD currency pairs over one month. Notably, during instances of EUR/USD rallies, there has been a consistent correlation where the GBP/USD has demonstrated a corresponding recovery in approximately 95% of cases.

During the preceding half-year duration, it is observed that the correlation between the two currency pairs exhibited a diminished strength, measuring at 0.66. However, when considering a more extensive timeframe of one year, it becomes evident that the currency above couples maintains a robust correlation.

On the other hand, it is essential to point out that the euro against the US and the dollar against the Swiss exchange rates demonstrated an exceptionally close negative correlation of -1.00. It can be inferred that there is a consistent inverse relationship between the EUR/USD and USD/CHF, wherein a rally in the former coincides with a sell-off in the latter, with a perceived occurrence rate of 100%. The observed relationship persists over extended durations, as the correlation coefficients exhibit notable stability.

However, it should be noted that correlations are not always characterized by stability. Consider the currency pairs USD/CAD and USD/CHF as illustrative examples. The observed correlation coefficient between the variables exhibited a robust positive association of 0.95 throughout the preceding year.

However, it is noteworthy that the strength of this relationship experienced a substantial decline in the most recent month, diminishing to a value of 0.28. Various factors may contribute to the pronounced volatility observed in specific national currencies over a brief period. Oil price swings significantly impact the economy of Canada and the United States, and the Federal Reserve of Canada’s aggressive posture is also a contributing factor.

Changes Can Be Observed in Correlations

It is evident, therefore, that correlations undergo fluctuations, thereby emphasizing the heightened significance of monitoring correlation shifts. Due to their tendency for rapid swings, mood and economic worldwide forces require constant assessment. The short-term correlations between currency pairings don’t reflect their future dynamics. The examination of the six-month trailing correlation holds significant importance.

This analysis provides a broader perspective on the normal six-month relationship among the currency above pairings, improving the analysis’s accuracy. Correlations undergo fluctuations due to a multitude of factors, predominantly encompassing divergent monetary policies, the susceptibility of a specific currency pair to commodity price movements, and the influence of distinctive economic and political circumstances.

How to Trade Foreign Exchange Using Correlations

Having acquired the knowledge of calculating correlations, it is imperative to delve into using them for advantageous purposes.

One potential benefit is the avoidance of entering into two positions that have a canceling effect on each other. By recognizing the consistent inverse relationship between EUR/USD and USD/CHF, it becomes evident that maintaining a portfolio with long positions in both currency pairs essentially results in a neutral position.

This is because the correlation indicates that when EUR/USD experiences an upward movement, USD/CHF will inevitably undergo a downward movement. Conversely, maintaining a long position in EUR/USD and a long position in AUD/USD or NZD/USD can be likened to amplifying exposure to a singular place due to the pronounced correlations between these currency pairs.

The consideration of diversification is an additional factor to be taken into account. Given the historical tendency for the correlation between EUR/USD and AUD/USD to not exhibit complete positivity, traders can employ these currency pairs as a means of risk diversification while upholding a fundamental directional perspective. A trader with a negative outlook on the US dollar can buy a single quantity of the Euro/US Dollar and one deal of the Australian Dollar/US Dollar instead of two lots of the Euro/US Dollar.

The operational mechanics of the hedge are as follows: Suppose a trader possesses a portfolio consisting of a short position in EUR/USD with a volume of 100,000 units and a temporary job in USD/CHF with a book of 100,000 units. In the event of a 10-pip or point increment in the EUR/USD currency pair, the trader’s position would incur a loss of $100.

Nevertheless, due to the inverse correlation between USD/CHF and EUR/USD, the short work on USD/CHF will yield a favorable outcome, potentially resulting in an approximate upward movement of ten pips, reaching $92.40. The proposed adjustment would result in a revised net loss of -$7.60 instead of the initial value of -$100.

Implementing this hedge strategy also entails the potential for reduced profitability in the event of a significant sell-off in the EUR/USD currency pair. However, it is essential to note that the magnitude of losses incurred is comparatively diminished in the most adverse circumstances.

Irrespective of one’s intention to broaden one’s portfolio or seek alternative currency pairs to capitalize on one’s perspective, it is imperative to maintain a keen awareness of the correlation between different currency pairs and the dynamic nature of their trends.

Professional traders, especially those whose accounts hold many currency pairings, can benefit significantly from acquiring this information. The acquisition of such knowledge enables traders to effectively engage in diversification, hedging, or profit amplification strategies.