The stock market concept has existed for an extended period, spanning many centuries. The interaction of the forces of supply and demand causes fluctuations in the stock market. The stock market can be characterized as a collective space in which individuals buy and sell shares. This expression refers to the numerical representation of ownership stakes in various businesses. These can be securities listed on a stock exchange, or shares traded exclusively on private markets. Private stocks include shares of non-public companies that are available to investors through trading platforms.

Elliott Wave Theory

The development of the Elliott Wave Theory dates back to the 1930s when its emergence can be attributed to the esteemed Ralph Nelson Elliott. The text presented a comprehensive study of market dynamics and the repetitive nature of patterns. The process becomes simple when one familiarizes oneself with the theory and grasps the fundamental ways. At the same time, a startling discovery was made that has since become widely used by many traders worldwide.

What Is the Essence of This Theory?

According to the theory, the primary pattern suggests that a trend develops sequentially in five waves. The presence of five waves characterizes the phenomenon known as momentum. The Market is expected to experience a three-wave pullback to correct the cycle, followed by a continuation in the direction of the five waves. To get a complete understanding of the patterns inherent in the theory, follow the link. The concept under consideration includes three fundamental rules that can bring significant profits if implemented accurately. As mentioned, the idea underwent considerable development in the 1930s, leading to substantial changes in our work today. Despite the unchanging influence of supply and demand, market execution has changed.

Trading Before the Advent of High Technology and Afterward

One needs only consider how difficult it was to execute a trade three-quarters of a century ago when the number of people bidding was considerably limited. According to the first census of stockholders conducted by the New York Stock Exchange (NYSE) in 1952, about 6.5 million people in the U.S. owned common stock. This figure represents only 4.2% of the U.S. population. According to Gallup, about 61% of the U.S. population owns stores. It is undeniable that the advent of technology has made it easier for traders to enter the Market. The source of personal computers and the Internet has opened up vast opportunities for market access. Increased participation in trading increases daily trading volume, which opens up more opportunities for potential financial gains.

The role of technology in our lives is very significant. The impact of technology can be seen in various areas, including social media, the Internet, and business transactions. The notion that technology does not affect the operation of the Market and reduces the impact of human involvement on the inherent nature of the Market is a simplistic view. Historically, individuals have transacted in stocks through financial institutions such as banks or brokers, with stock movements being dependent on trading volume, potentially leading to various changes in direction.

Changing the Market using computers has been considered for quite some time. The advent of computers for high-frequency trading has dramatically accelerated buying and selling. EWF has developed a system designed to harmonize the traditional Elliott Wave Theory with the modern practice of high-frequency trading seen in today’s Market. Waves and patterns have been carefully analyzed, using the theory as a linguistic tool to derive sequences. Sequences allow traders to trade on the right side of the Market. When the Market is correct, it exhibits movement patterns corresponding to simple lines of three, seven, and eleven. This area was successfully identified and subsequently named the “blue box” area by team members.

Below are several instances of the Blue Boxes.

The stock symbol $TSLA, representing Tesla, has experienced a corrective movement known as the Grand Super Cycle, resulting in a decline in trading activity since its peak in 2022. This correction can be observed through a simple ABC or Three waves pattern. The Blue Box area was introduced to the members as the designated entry point into the Market.

The assigned area, represented by the blue Box, is a common ground for buyers and sellers to reach a mutual consensus regarding the market direction. The concept revolves around sellers exerting downward pressure until reaching the upper boundary of the Blue Box, subsequently utilizing the Box as a means to secure profits.

On the contrary, potential purchasers exhibit patience in their anticipation of entering the Market at the pinnacle of the azure enclosure. In modern trading, computers have assumed the role of traders due to the inherent impossibility of executing trades with utmost precision at every fleeting moment.

Presented is a weekly chart of TESLA, highlighting the potential buying zone.

$TSLA weekly Elliott Wave chart

Tesla’s response is depicted in the designated blue box region:

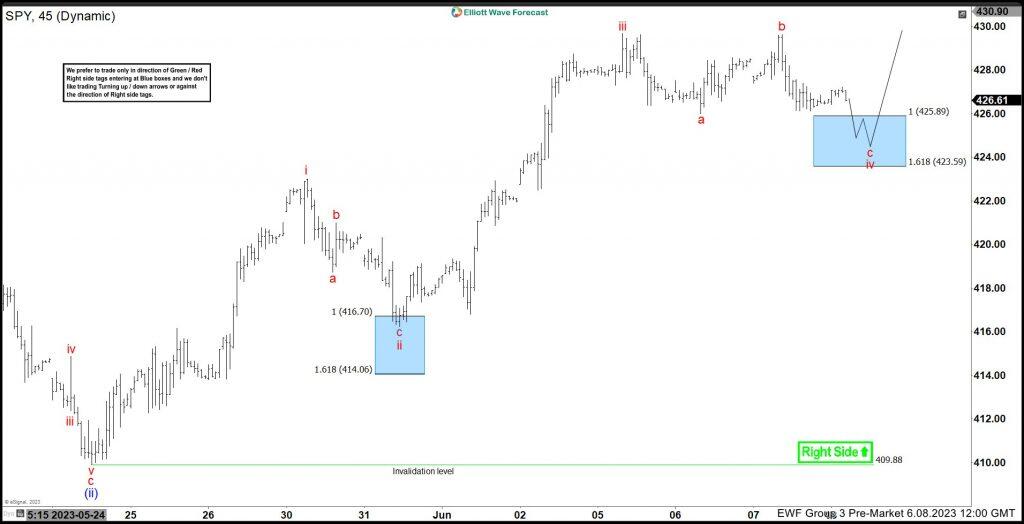

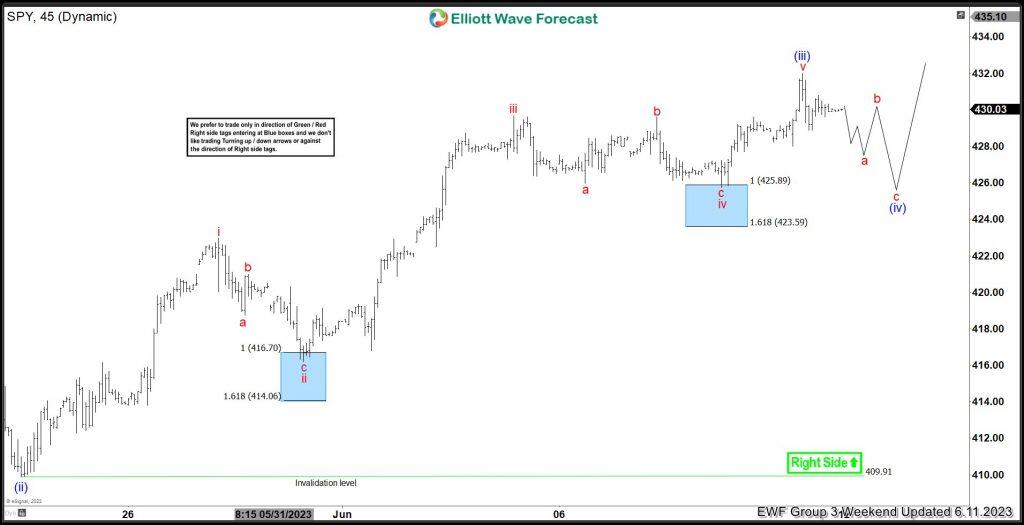

An additional illustration can be found in $SPY, which has exhibited an upward trajectory within the cycle commencing 10.13.2022 and the shorter process starting 03.2023. The Index experienced a pullback characterized by three waves within the more significant impulse of wave iv. The blue box area, recognized by our members, refers to the high-frequency trading zone.

On 06.08.2023, SPY was presented to members with the anticipation of the Instrument reaching the High-Frequency Trading area.

$SPY 1 hour Elliott Wave chart

SPY exhibits a response near the designated High-Frequency Trading region, commonly called the blue box. The Index experienced upward movement during wave ii and wave iv.

Another example can be observed in the case of Gold, where a correction in the weekly chart occurred, resulting in a straightforward ABC pullback. The metallic entity was directing its focus towards the designated region characterized by a hue of blue, wherein potential purchasers were positioned in anticipation.

The Weekly chart displays the anticipated region denoted by the blue box.

Gold ($XAU/USD) weekly Elliott Wave

Presented is the most recent Weekly chart, showcasing a notable response originating from the designated blue box region.

In summary, it can be observed that the Market has transformed throughout the years, with the advent of computers revolutionizing the operational dynamics of trading. The current market conditions exhibit distinct zones. The predefined areas manifest themselves once the connector within the correction occurs. During that particular instance, the corrective aspect persistently exerts pressure within the box’s confines. At the same time, the right side patiently lingers at the box and subsequently engages with the Market.

It should be noted that the attainment of the Blue Box does not necessarily guarantee a profitable trade outcome. The reaction occurrence is associated with the Market’s correction, which typically follows a pattern of three, seven, and eleven swings. The Boxes occasionally elicit a response following a sequence of three waves, propelling towards the seventh. Regarding the primary cycle pivot, initiating positions aligned with the three, seven, and eleven sides is advisable, ensuring the inclusion of High-Frequency Trading in your strategy.