Trend indicators indicate pivotal moments during which a trend might be materializing. The Alligator Indicator, conceptualized by American trader Bill Williams, serves the purpose of discerning the potential emergence of a movement and ascertaining its directional bias. Furthermore, it can be utilized to determine the lack of a discernible pattern.

The indicators developed by Bill Williams exhibit nomenclature that is notably more vibrant than conventional analytical instruments. Instead of utilizing the traditional ATR or RSI indicators, Bill Williams deliberately employed the notably dubbed Awesome Oscillator Indicator. The utilization of animal analogies by Bill Williams is a notable aspect that contributes to the rationale behind the terminology of the Alligator technical indicator.

Why Draw Comparisons to Alligators with This Indicator?

The utilization of the alligator analogy elucidates certain market behaviors during its transition from a non-trending state to a trending state. The concept at hand pertains to the lack of a discernible pattern within the market, specifically referring to intervals characterized by lateral movement.

This can be metaphorically likened to an inactive alligator in a dormant state. Subsequently, the alligator becomes alert and pursues its intended target. As the duration of its slumber increases, the creature’s appetite intensifies, thereby amplifying the observed pattern.

According to Bill Williams, a trader must comprehensively understand the market’s structure to succeed. From the perspective mentioned above, it is noteworthy that the Alligator indicator encompasses three distinct moving averages, each subjected to a smoothing process across varying time intervals, aptly referred to as ‘balance lines’ by its creator.

One can discern the underlying market structure through careful observation and analysis of the balance lines. This assessment lets us ascertain whether we are currently confronted with a dormant alligator.

The Three Balance Lines Comprise the Alligator Indicator

The balance lines are designated as the anatomical features of the alligator, specifically the jaw, teeth, and lips. These lines are outlined as follows:

- The Alligator’s Jaw represents the slowest moving average among the three and is conventionally depicted in blue. The provided information pertains to a 13-period moving average advanced by 8 bars.

- The Alligator’s Teeth is a moving average indicator that is colored red. It represents the intermediate moving average of three moving averages. It is smoothed throughout eight and shifted forward by 5 bars.

- The Alligator’s Lips indicator is visually represented as a green line on a chart. It is derived by calculating a 5-period moving average and shifting it forward by 3 bars.

The specific procedure for computing the moving averages within the Alligator indicator is of relatively minor significance, as the MetaTrader trading platforms will handle the calculations on your behalf.

The behavior exhibited by these lines indicates the alligator’s condition, thereby reflecting the state of the market. Before delving into a comprehensive examination, it is imperative to incorporate the Forex Alligator Indicator onto a chart within the MetaTrader 5 platform.

Instructions on How to Make Use of the Alligator Indicator in MetaTrader 5

The Alligator indicator is a standard feature in MT4 and MT5 trading platforms. While our focus is on utilizing the indicator in MT5, it is essential to note that the process remains consistent across both platforms.

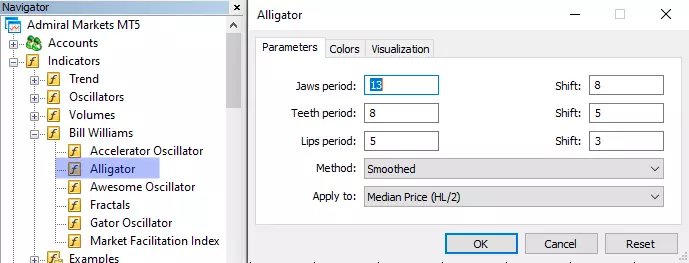

MetaTrader possesses a designated directory wherein Bill Williams indicators are conveniently stored. The folder can be found within the ‘Indicators’ directory, located in the ‘Navigator’ window positioned on the left-hand side of the screen, as exemplified below:

Upon selecting the Alligator indicator from the designated folder, users will be presented with the corresponding dialogue box, as depicted in the image above. The parameters have been established according to the default settings of the Alligator technical indicator. Upon selecting the ‘OK’ option, the visual elements comprising blue jaws, red teeth, and green lips will be rendered and displayed on your chart.

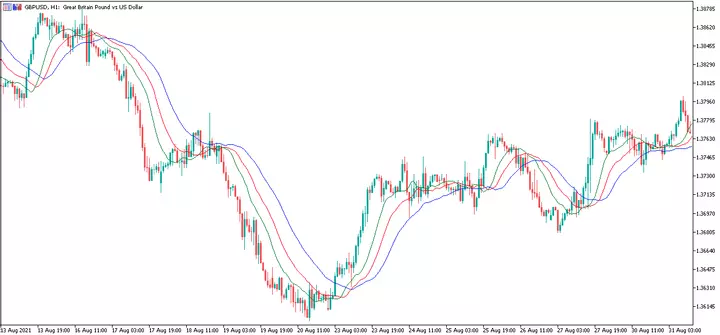

The presented chart depicts the hourly GBP/USD exchange rate and showcases the application of the Alligator technical indicator.

A Strategy Using the Alligator Indicator

Previously, it was discussed that the Alligator technical indicator provides three fundamental pieces of information about Forex markets. These include identifying a lack of trend, the emergence of a movement, and determining its direction. The subsequent discourse shall examine each of the components above to elucidate their potential utility within the framework of an Alligator indicator trading system.

The Lack of a Trend

The condition above frequently manifests within the Forex market, denoted by the convergence or intertwining of the three lines comprising the Forex Alligator indicator. The highlighted portions of the chart below exhibit an intersection and intermingling of the green, red, and blue lines.

The observed behavior of the alligator suggests a state of dormancy, indicating a lack of significant market activity. Consequently, we find ourselves in anticipation, awaiting a potential shift in market conditions.

The Development of a New Pattern

The successful initiation of the alligator’s awakening is discernible when the rapid green line intersects the comparatively sluggish lines, prompting the latter to align in the same trajectory, thereby resulting in the divergence of all three lines.

When the Forex Alligator indicator’s dental structures, labial components, and mandibular apparatus exhibit significant separation, it can be inferred that the indicator above has transitioned from a state of dormancy to an active phase characterized by consumption. The duration of the alligator’s inactivity directly correlates with its heightened appetite, thereby prolonging its pursuit of sustenance. During persistent trends, the Alligator technical indicator demonstrates enhanced efficacy.

The Path That the Trend Is Taking

The observable displacement of the equilibrium lines determines the direction. The green line, the fastest moving average, is anticipated to exhibit initial movement, succeeded by the red line and, ultimately, the blue line.

The green line surpassing the slower lines signifies the manifestation of a buy signal. The occurrence of a crossing below indicates the image of a sell signal. All three indicators exhibit an upward movement and expansion, substantiating an upward trend. If the balance lines show a downward trajectory and develop after a sell signal, it confirms the presence of a downtrend.

As the prevailing trend reaches its conclusion, the convergence of the balance lines becomes more apparent. The fast green line intersecting with the slower lines indicates that the alligator’s hunger has been appeased, thereby serving as a signal to realize one’s gains.

The primary advantage of the indicator lies in its ability to facilitate adherence to a consistent trend. One of the potential challenges associated with this task involves the difficulty in accurately interpreting the initial indicators within a suitable timeframe.

During the rest period, when the lines converge and intertwine, numerous intersecting patterns resembling trading signals will manifest. The crucial aspect lies in diligently seeking the confirmatory divergence of the balance lines, ensuring promptness to prevent substantial omission of the initial phase of the trend.

The presented daily USD/CHF chart shows that the initial vertical red line signifies a buy signal. This is evident as the green line intersects above the remaining balance lines, leading to a divergence among all three lines. This divergence serves as an indication of the presence of the feeding alligator.

Following those above, the second red vertical line indicates the green moving average of the Alligator indicator crossing below the remaining moving averages. The present indication suggests the opportune moment to initiate the selling process.

Conclusion

The Forex Alligator Indicator trading system presents a visually vibrant representation that deviates from conventional indicators, potentially captivating specific individuals.

Although the trading rules have a certain degree of memorability, they tend to be vagueness. It is advised to thoroughly test the indicator before its utilization to ascertain its efficacy in producing favorable outcomes specific to your circumstances.