Introduction to Ex-Cap

Ex-Cap is a retail trading name gaining increasing traction among traders who own crypto. This brand introduces crypto-denominated instruments (CDIs), promising you won’t need to exchange crypto for fiat in order to trade popular markets.

Today we’ll discuss some of the benefits associated with trading CDIs, as well as some of the reasons why Ex-Cap is growing into a popular choice. In case you have not traded before with tokenized assets, no need to worry, since the user experience is almost the same as with other financial derivatives.

Instruments

For someone believing in the long-term potential of crypto, selling tokens to trade is not the ideal choice. Ex-Cap claims that you can get exposure to hundreds of tokenized assets, denominated in crypto, without selling your coins.

Traders really seem to have great optionality, considering the list of CDIs includes:

- Currencies

- Metals

- Shares

- Cryptocurrencies

- Indices

- Energy

You don’t need a large trading account to access the above-mentioned instruments. Spreads look good, especially when it comes to liquid assets. Ex-Cap also promises accurate execution, a key feature for traders actively engaging the markets.

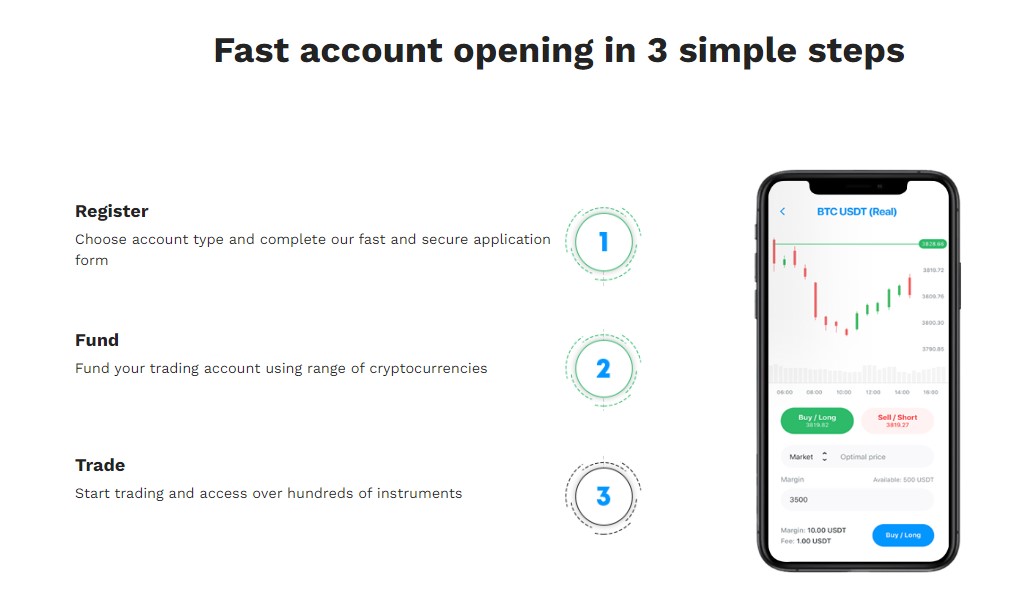

Registration

Speaking of registration, the process is relatively simple and very fast. The first step is to choose an account type between Basic, Classic and Individual. You have to provide some personal details and once the account is open, you’ll need to upload some identification documents for KYC purposes.

Because all tradable instruments available with Ex-Cap are denominated in crypto, traders have to deposit in a range of coins. Conversely, when you want to withdraw, the transfer will be completed in your personal crypto wallet.

There are major differences between account types. Only the Basic account carries trading commissions, while the other two only spreads and overnight swaps. The broker provides technical support whenever needed and Individual account holders benefit from support granted by a dedicated account manager.

Are CDIs Safe?

Since you are depositing crypto with the broker, one of the main concerns is whether your coins are kept safe. According to Ex-Cap, the company uses state-of-the-art security systems to ensure that’s the case.

The majority of funds are kept in cold storage using qualified custodians. Cold storage solutions continue to be the most reliable choice since nobody can access the funds via the Internet.

Security is further reinforced because Ex-Cap is a registered brand with the FSA and regulated by M.I.S.A. When a broker is regulated, ensuring security for customer funds and privacy are two of the most important requirements.

Final Thoughts

As a whole, Ex-Cap has a competitive trading offer, showing that CDIs are a promising choice. The brand does extensive work to ensure a high level of protection for customer funds. When it comes to trading terms, you don’t need a large pool of capital to get started. There are three different accounts and each one carries decent conditions. The trading offer is transparent and you can learn more about it using the brand’s website.