The Forex market, short for the Foreign Exchange market, is a marketplace dedicated to trading various currencies. It is the most expansive global financial market.

This financial entity’s daily turnover ranges from 5 to 7 trillion dollars. At the same time, prominent entities primarily control the industry, including global financial institutions, investment funds, and multinational companies. The market also includes a wide array of independent traders.

In Forex trading, currencies are exchanged in pairs. The EUR/USD pair offers the opportunity to exchange for dollars at the prevailing market rate. Similarly, the GBP/JPY pair allows for an exchange of pounds for yens and vice versa.

The potential profits that traders and market participants can attain are contingent upon the fluctuations in exchange rates and market conditions. Consequently, traders endeavor to purchase currency at the most advantageous price and sell it at the most favorable rate.

Many factors influence market fluctuations, such as the interest rate determined by central banks, the prices in raw materials markets, the political landscape, and various other elements. Multiple factors influence the formation of a currency’s costs, although this has yet to be the historical norm.

Let us explore the origins, evolution, and current state of the Forex market to understand its emergence, growth, and present characteristics.

What Does Bretton Woods Mean?

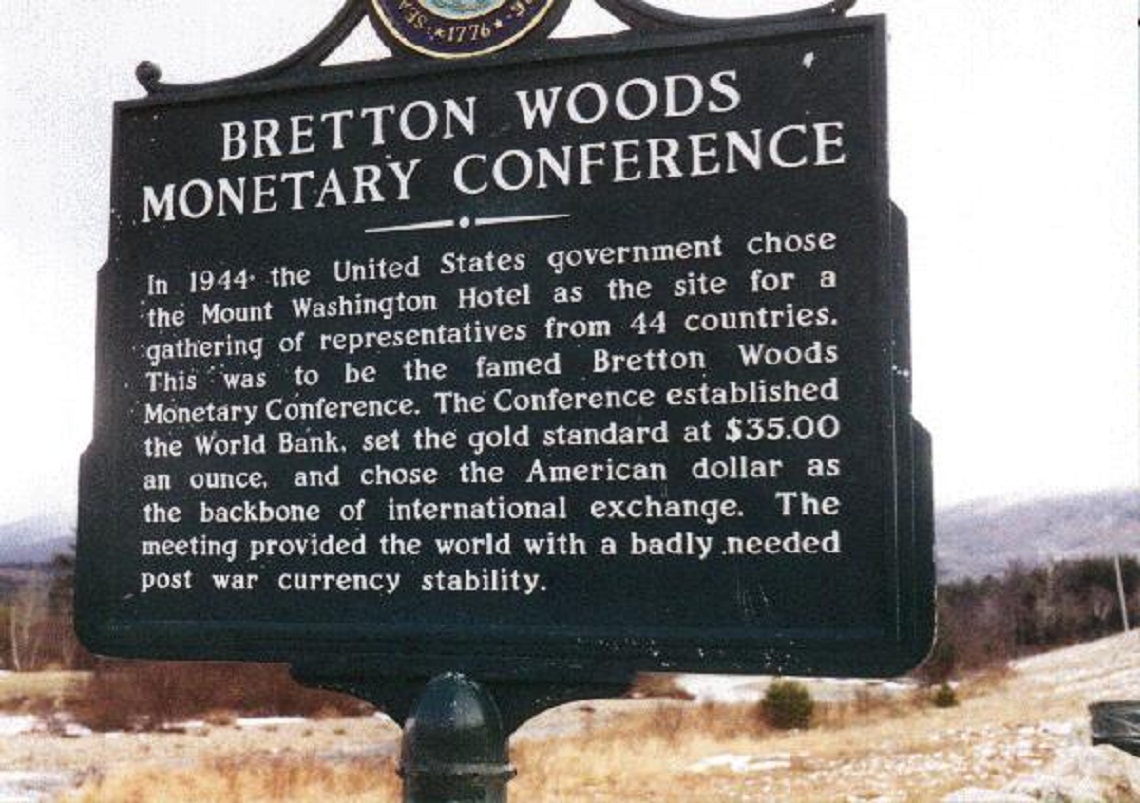

Let us delve into the era preceding the establishment of the Forex market and explore the intricacies of how international financial relations were structured. The Bretton Woods system of international financial organization was adopted by various nations in 1944. During that period, the process of converting one currency into another was more complex than it is today.

During the change process, acquiring dollars by trading the currency one possessed was necessary. If one were inclined to chase pounds yet only had francs, it would necessitate the execution of two distinct transactions. One strategy is to exchange francs for dollars and then use the dollars to purchase pounds. In the present times, systems need more convenience.

Simultaneously, the dollar’s value remained stable and was backed by the precious metal gold. The dollar’s value was equivalent to the weight of a troy ounce, which is slightly over 30 grams of gold. Exchange rates for all major currencies were fixed against the dollar, and any adjustments could only be made through devaluation or revaluation mechanisms.

During that period, the primary global currency used for exchanging one money for another was the United States dollar. However, it became evident that assigning such an immense burden to a single currency has an overwhelming influence on the system and ultimately results in its downfall. Therefore, a more significant amount of funds was required to meet the essential requirements of the global currency market.

This resulted in a scenario where the US authorities had to employ emissions as a solution. As a result, it became unfeasible to uphold the official exchange rate between the currency and the existing gold reserves. In terms of its official value, the dollar continued to be equivalent to one troy ounce of gold. However, in practice, the government was unable to fulfill this commitment.

The Failure of the Bretton Woods Mechanism to Function

Due to the requirement that a specific quantity of gold support the dollar, individuals could convert their dollars into gold at the officially established exchange rate. In 1965, approximately 1.5 billion dollars was amassed within the National Bank of France. At that time, President Charles de Gaulle requested that the President of the United States exchange this monetary sum for gold at the officially designated rate.

The quantity was determined to be 16,500 tons of gold, representing over 70 percent of the total gold holdings in the United States. In his pursuit, Charles de Gaulle aimed to question the prevailing system that regarded the US dollar as the primary global currency.

Due to these circumstances, the United States was compelled to impose restrictions on converting currency into gold in 1968. Consequently, two distinct rates for gold relative to the dollar emerged – an official rate and a market rate.

The inception of the Forex market can be traced back to 1971 when an individual initiated its creation.

It cannot be definitively stated that he was solely responsible for creating the Forex market, but his influence on its development was undoubtedly significant. The individual in question is Richard Nixon. The chain of events commenced with his choice to eliminate the gold standard.

Following that, there were multiple instances of the dollar experiencing devaluation. In 1973, a significant event called the International Jamaica Conference occurred, during which all currencies transitioned to market regulation. Subsequently, three years later, the Jamaica Accords were adopted by all nations, marking a complete shift in currency policies.

Jamaican Agreements

The current system is characterized by its distinct feature of floating exchange rates, which are determined based on the prevailing market conditions. This sets it apart from the previous design.

With the introduction of this system, three different exchange rate regimes emerged. The initial one was the fixed exchange rate regime. Under this regime, the government sets an official ratio between the national and foreign currencies, allowing for slight fluctuations within a small percentage range.

The system comprises various mechanisms, one of which is dollarization, which involves using a foreign currency within the country as a medium of exchange. Typically, this strategy is employed by smaller and miniature nations, which prefer adopting the currency of their closest neighboring countries.

One commonly used mechanism is linking the exchange rate to another currency, typically one of the major global currencies.

The third mechanism refers to the conventional fixed peg arrangement, where the exchange rate is tied to a collection of currencies, like a currency basket.

The fourth regime is the unclean floating regime, which encompasses various mechanisms, such as the adjusted exchange rate regime. This particular regime involves tying the exchange rate to a set of economic indicators. The creeping fixation is a notable mechanism where the central bank intervenes in the market to maintain a specific exchange rate value.

The regime incorporates additional mechanisms, such as implementing pegged exchange rates within horizontal bands, wherein the government endeavors to maintain the exchange rate fluctuations within specific boundaries.

The regime employs additional mechanisms, such as maintaining pegged exchange rates within specific bands, aiming to restrict the extent of exchange rate fluctuations.

Additionally, a currency system employs a fluctuating exchange rate, which is determined by market forces. Most developed nations widely adopt floating exchange rates, making them the preferred choice for currency trading. This regulatory framework ensures that currencies are subject to market forces, resulting in increased trade activity.

The Current Foreign Exchange Market

A recent surge in technological advancements has significantly impacted the financial markets. In 1984, a significant development took place in the United States with the establishment of NSFNET.

This network was specifically designed to facilitate communication among various universities. Over time, its reach expanded exponentially, and by the year 1992, an impressive number of 7,500 networks had become interconnected through this system.

The widespread accessibility of the Internet has revolutionized the trading landscape by enabling the emergence of online Forex brokers, which have replaced traditional offline brokers. This transition has significantly impacted the market’s expansion, leading to a reduction in trading spreads and an increase in leverage options for traders.

With the advent of modern technology, individual traders now have the incredible opportunity to engage in trading activities across the globe, around the clock, using any currency of their choice.