Introduced in 1896, the Dow Jones Industrial Average (DJIA) is one of the oldest market indices and continues to be widely utilized today. Additionally, it is one of the most straightforward, containing just 30 elements.

It’s pretty uncommon given that other well-known market indices like the S&P 500 or the NASDAQ monitor a significantly more significant number of constituents – 500 and 100, respectively. Given its extensive history and somewhat limited scope, what factors contribute to the continued use of the DJIA as a market benchmark and its ongoing trading activity?

In this article, we will explore the DJIA in detail, delving into its composition, significance to the economy, and the trading opportunities it presents to investors.

What is the Dow Jones Industrial Average?

The DJIA, also known as the Dow or the DJ30, is a notable market index that monitors the leading 30 publicly traded blue-chip companies in the United States. Formed by the collaboration of Charles Dow and Edward Jones, it is the second-oldest market index in the United States, preceded only by the Dow Jones Transportation Average.

The Dow gained recognition in the 20th century when it was noted that the success of industrial companies was linked to the economic expansion of the US. This solidified the DJIA as a significant gauge of the American economy, and even today, the power or fragility of the Dow is seen as a reflection of the power or fragility of the economy.

The Dow’s ability to function effectively as a market benchmark, despite only tracking 30 companies, can be attributed to the high quality of its exclusive constituent list. Although originating from various industries, the 30 companies monitored by the Dow are all exceptional companies that have demonstrated a consistent track record of stable earnings.

Trading Hours of the DJIA

Since the Dow stocks are also included in the S&P 500 and the NASDAQ, traders can keep track of the New York Stock Exchange’s trading hours.

- Weekdays 9.30 am to 4 pm

- Phase before the official opening

- Early morning hours before the market opens: 4:00 am to 9:30 am

- After hours: 4:00 pm to 8:00 pm

Advantages of Dow Jones trading

Because of its limited concentration on only thirty companies, the Dow Jones Industrial Average is appropriate for investors who wish to concentrate on the top blue-chip publicly traded companies in the United States.

Comparatively to the hundreds in the NASDAQ or the S&P 500, keeping up with news and earnings of thirty companies is clearly easier. Remember that the DJIA basically gauges the top of the crop of the worldwide stock market even though it tracks fewer companies.

Although there are undoubtedly times when the Dow underperforms—for example, during tech rallies when the NASDAQ dominates—the index is more than suitable over the long run.

Previous Dow Jones Trends

The Dow’s historical returns chart shows the overall arc of the U.S. economy as a whole. With record-breaking returns in 1995 (36.94%), 2003 (28.28%), and 2013 (29.65%), good economic performance during the 1990s saw the Dow enjoying some of its best years.

Though it is less concentrated in tech than the NASDAQ or the S&P 500, the Dow suffered during the dot-com bubble of the 2000s. This shows the broad effects of the U.S. Federal Reserve’s actions when it steadily raised interest rates from 1999 to 2002 in an effort to slow down the stock market.

The Dow dropped 15% in 2002, a significant decline only seen once in 2008 when the subprime mortgage crisis saw the index end the year down by 31.9%.

With positive gains annually up to 20%++ except for a 1.10% decline in 2022, the Dow has shown a consistent increasing trend since then.

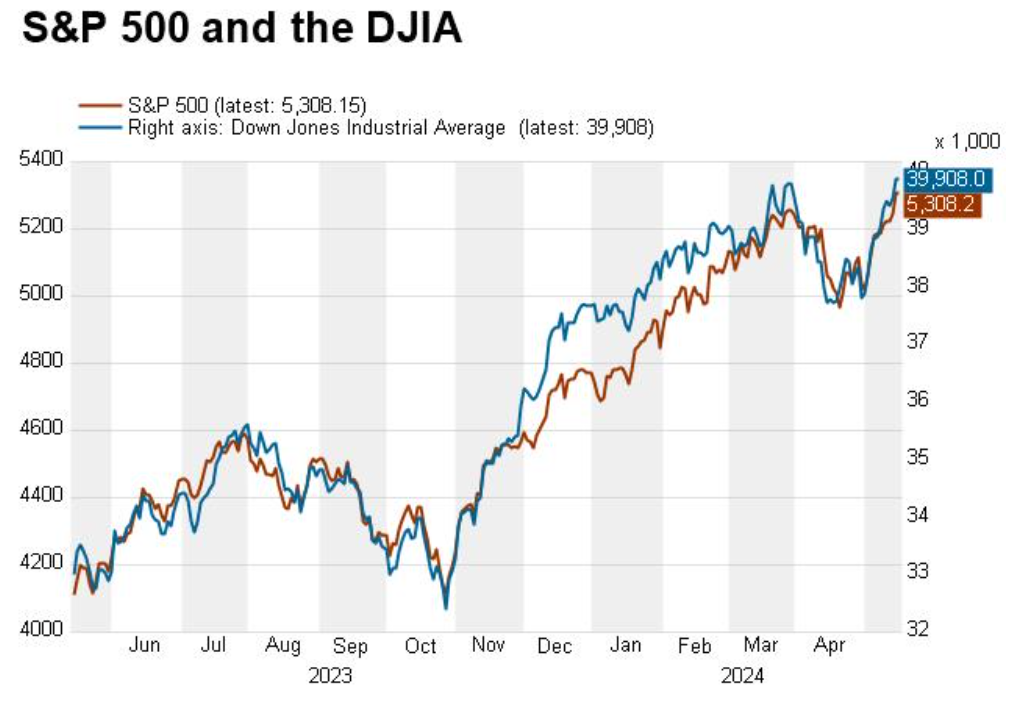

The Dow still presents great trading opportunities for investors today. As seen in the screenshot below, the index is keeping up fairly with the S&P 500.

Tips for Trading the Dow Jones

Trading or investing directly in the DJIA is not possible since it is an index. That’s because it’s merely a gauge of publicly traded, top-tier American companies and doesn’t possess any shares of those companies.

Therefore, investors may consider utilizing alternative financial instruments like Contracts-for-Difference (CFDs) or index Exchange-Traded Funds (ETFs) in order to engage in trading or investment activities related to the index.

Trade the Dow Jones Industrial Average Index using CFDs

CFDs are financial instruments that allow investors to speculate on the performance of an underlying asset, such as the DJIA. There is no direct possession involved; only the price movement is exchanged.

There are numerous advantages to utilizing CFDs to trade the DJIA. Firstly, you have the option to engage in leveraged trading, which can significantly enhance your profits in the event that the index moves in the anticipated direction. Nevertheless, in the event that the index moves unfavorably, the use of leverage will magnify your losses. Therefore, it is crucial to exercise prudence and exercise caution when employing leverage.

Additionally, CFDs offer the opportunity to capitalize on the movement of the DJIA in both upward and downward directions, allowing you to profit from price fluctuations potentially.

CFDs provide a more accessible entry point, allowing you to begin trading with a smaller amount of capital.

To initiate a trade, you have the option to select whether the index will experience an upward or downward movement. If the price aligns with your position, you can generate a profit. If it contradicts your stance, you will suffer a disadvantage.

Upon the conclusion of the agreement, the variation in the index price is promptly resolved and reflected in your account. It is unnecessary to assume responsibility for stocks that are included in the DJIA.

Trade CFDs on the Dow Jones Industrial Average Index ETFs

As previously stated, utilizing an index ETF provides an opportunity to invest in the DJIA. These ETFs aim to mirror the Dow’s performance by investing in identical stocks with the same proportions.

Investors can purchase shares of a DJIA index ETF and enjoy profits when the Dow increases in worth. When the index experiences a decline, the cost of your index ETF shares also decreases. Given the stock market’s inherent unpredictability in the short term, it is advisable to use index ETFs as part of a long-term strategy.

To overcome these limitations, traders have the option to invest in DJIA ETFs through CFDs. This approach functions similarly to the one described earlier, providing the same three advantages of leverage, the profit potential in both directions, and lower initial capital required for trading.

Dow Jones Trading Strategies

Because the Dow is dynamic and made up of many different stocks, it can be used for a wide range of short-, medium-, and long-term trading strategies.

Trading Strategies for the Short-Term

Day Trading

If you want to make as many winning trades as possible in a short amount of time, try day trading. Day traders try to make a lot of small wins instead of a few big ones.

Day traders should close their positions before the end of the trading day rather than hold them overnight. This is to avoid overnight risk, which occurs when news or events come out of the blue and change the market on their trade.

News and Trading

Due to the smaller number of companies that make up the Dow, a news trading strategy is pretty easy to use for it. Traders who use this strategy can take it easier when they trade, but investors should still be ready to act quickly on news or events that happen quickly.

An economic calendar can be helpful for news traders who need to keep track of important news stories and information such as corporate earnings, economic reports, consumer trends, and so on.

Trading Plans for the Middle Term

Trading in Swings

Traders who use swing trading try to make money when the Dow’s price suddenly changes direction.

When the price changes from going up to going down or from going down to going up, this is called a swing. There may be short swings of a few hours or days or longer ones that last for weeks or months.

To be successful at swing trading, you need to be able to accurately predict when swings will happen and then place the right trades to take advantage of them. It’s possible to make more money during longer swings, but you also run the risk of not being able to close your trade-in time. Setting reasonable profit goals and not giving in to greed are very important.

Strategies for Long-Term Trading

Trading the Dow is like trading the best of the U.S. economy because it tracks the most prominent and most influential companies on the stock market.

It has been 20 years, and the Dow has only been in the red five times.

With this track record, long-term trading strategies should be able to pay off big for investors who are willing to wait.

But because the Dow is just an index, it can’t be bought or sold directly. So, investors who want to copy the long-term performance of the DJIA would need to put their money into the DJIA ETF.

At the moment, there aren’t many ETFs that track the DJIA. Some that are available are:

- If you want to buy an ETF that exactly copies the DJIA, this is the only one you should get. The EDOW gives each Dow component the same weight. This ETF doesn’t use price to judge them.

- It only holds stocks in the DJIA that pay dividends. This is called the Invesco Dow Jones Industrial Average Dividend ETF (DJD).

When looking at any investment fund, remember to check the expense ratio. This is the fee that the fund managers charge to run the fund. Index ETFs have some of the lowest costs, but over time, these costs can cut into your returns.

AI Definity has quipped its trading platform with quality tools and advanced trading algorithms which help traders executes trades effectively.