Are you interested in making forex your primary source of income? Here’s how you can achieve that goal. It is essential to consider this question as you embark on your trading journey, as it reflects your responsible attitude and patience. Prepare yourself. Having a well-defined strategy and a systematic approach is crucial for achieving profitability in the forex market.

Many inexperienced traders are more focused on making quick profits in forex rather than taking the time to learn and develop their skills. They often neglect essential steps such as studying forex trading tips for beginners and practicing on a demo account, which is crucial for establishing a solid trading strategy.

If you want to trade without any risks or losses, it is essential to dedicate time to learning the fundamental concepts and terms associated with professional forex trading strategies. It is highly recommended that you explore established trading strategies provided by experienced traders. These strategies have been thoroughly tested and proven to be effective.

In order to determine which strategy will be most effective for you and your trading style, it is crucial to conduct thorough testing beforehand. So, what makes having a strategy so important? An effective trading strategy enables a thorough understanding of market dynamics and facilitates accurate price movement predictions. Experienced traders understand the importance of having a well-defined system that aligns with their trading goals.

A trading strategy is like a guiding light, providing a set of defined rules to navigate the market. Without it, you may find yourself lost and directionless. To ensure profitability, it is essential to adhere to specific guidelines. An expertly crafted trading strategy enables a trader to confidently enter the market under particular conditions and exit within the designated timeframe, all while generating a profit.

It’s essential to recognize that losses in the foreign exchange market can affect anyone, regardless of their experience or expertise. Ultimately, your trading attitude and level of commitment will determine your success.

A Guide to Selecting the Most Effective Forex Trading Strategy

When selecting the optimal Forex strategy, it is crucial to consider three key factors: the time frame, the number of opportunities, and the position size.

Time Frame

When selecting the optimal Forex strategy, it is crucial to identify a fitting time frame. Suppose you are looking to maximize your profits by capitalizing on small price movements in the market. In that case, it is essential to concentrate on shorter time frames and employ a scalping strategy.

Various periods, including extended, moderate, and brief, pertain to distinct approaches.

Exploring Potential Trades

When considering a strategy, it is essential to carefully view the number of positions you wish to open. If you are looking to open multiple positions quickly, a scalping strategy may be suitable for your needs.

Alternatively, traders who prioritize in-depth analysis of reports and factors from fundamental analysis can minimize time spent on chart observation. They have a preference for more extended time frames and more prominent positions.

Size of the Position

Finding the right trade size is crucial for success. To be successful in trading, it is essential to have a clear understanding of the potential risks involved. Overextending yourself financially can result in excessive spending.

Experienced traders recommend establishing a risk limit for every trade. When a trader sets a 1% limit on their trades, it ensures that they will not jeopardize more than 1% of the assets deposited into the account.

In general, if you prefer to open a smaller number of trades, invest a more significant amount of money in each position.

FX Trading Strategies That Are Effective

Many inexperienced traders often need to pay more attention to essential aspects of their strategy, which can significantly increase their risks. It is necessary to select a method and adhere to its guidelines diligently when you are in the early stages. Now, let’s delve into the widely used forex trading strategies for beginners.

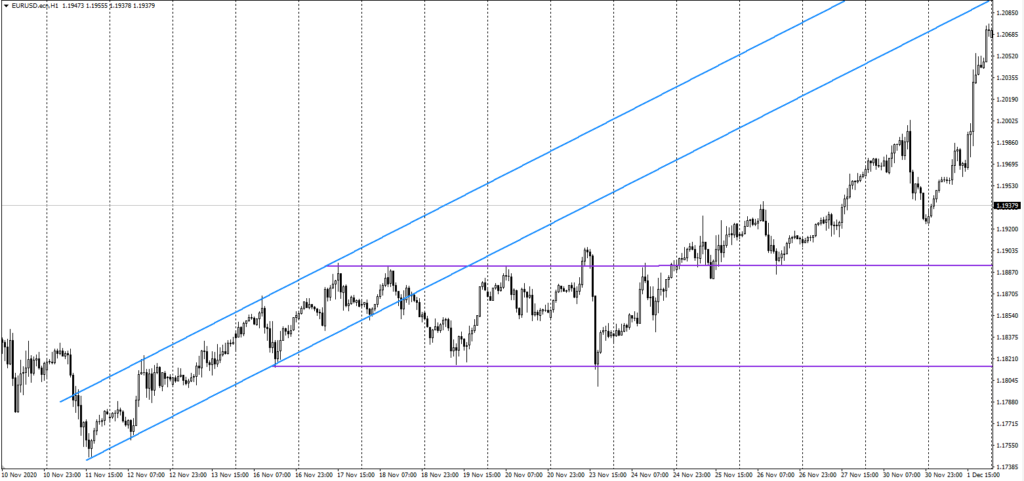

Channel Trading Strategy

This forex trading strategy is highly regarded for its effectiveness, making it particularly appealing to beginners who are in the process of grasping the fundamental principles of the forex market. Understanding the support and resistance levels formed within the trading range is crucial for enhancing trading expertise. The primary objective of this technique revolves around the volatility of the forex market, which is characterized by constant fluctuations.

A forex channel strategy can be implemented when a distinct price corridor, or channel, is clearly visible on the chart. The channel boundaries can be identified by the upper and lower bar, beyond which the currency value remains within a specific range over a given period. Currency trading is conducted based on the data of the channel. It is recommended to maintain the trade until the price reaches the opposite level of the channel.

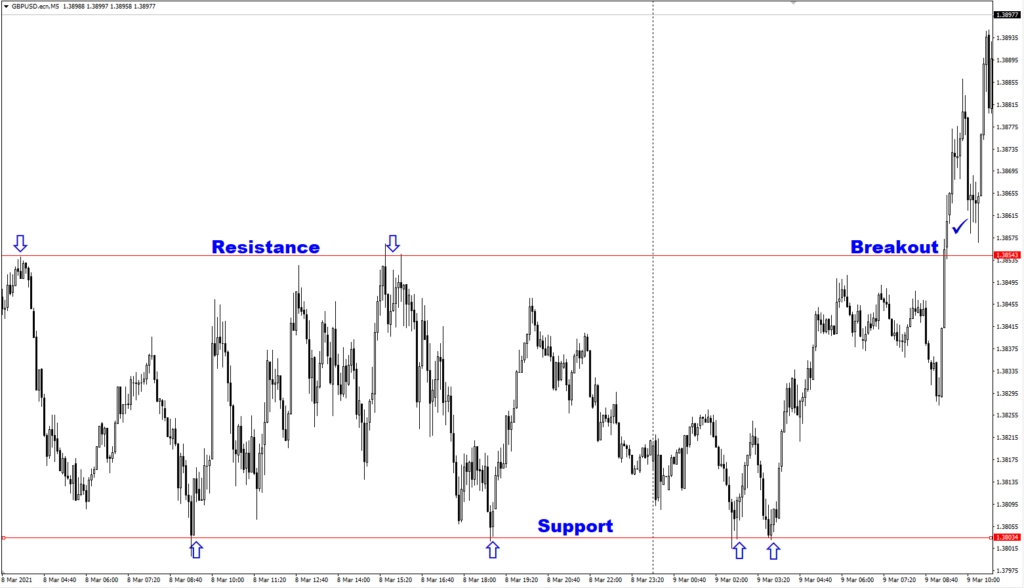

Breakout Strategy

When a breakout occurs, it means that the price has surpassed a predetermined level of support or resistance, accompanied by a surge in trading volume. Breakout trading is widely recognized as a significant strategy due to the fact that these “breakouts” serve as indicators of heightened market volatility. One can leverage market volatility by capitalizing on emerging trends as they are identified.

Based on a breakout strategy, traders typically enter a long position when the market price surpasses a resistance level or enter a short position when the price drops below a support level. Nevertheless, as per the advice of seasoned traders, it is recommended to exercise patience until there is a clear indication that a breakthrough truly signifies a genuine up or downtrend. It is recommended to position your stop loss either above or below the breakout candle, at the very least.

Effective Triple Candlestick Strategy

This trading strategy is straightforward yet highly effective, making it ideal for beginners. It ultimately boils down to identifying a specific combination of three candles. Keep in mind that the accuracy of Price Action signals increases as the chart interval gets higher, so you have flexibility in choosing your timeframe. It is important to note that the extremum of the first candle in the pattern should always be either higher or lower than the extremum of the previous candle.

The confirmation of this correction should be evident with the appearance of the second candle in the pattern. When the highest and lowest points of the two previous candlesticks on the chart show a consistent pattern of increase or decrease, the third candlestick tends to follow the same trend.

A trader should execute an order when the third candlestick is formed. When there is a decrease in price, it is advisable to open a sell position. Conversely, if there is a steady increase in price, it indicates a good opportunity to open a buy position.

- When a downtrend is detected on the chart, it is essential to note that the High and Low prices of the initial candle in the pattern ought to be less than the High and Low prices of the candle before it.

- When there is an uptrend on the chart, it is advisable for the trader to wait for the formation of a candle patiently. This candle should have an extremum that is greater than the extremum of the one before it.

Final Thoughts

It is advisable to allocate additional time to thoroughly understand the theory before putting it into practice. It is highly recommended to explore and evaluate the strategies mentioned above on the demo account, which provides a risk-free environment for trading and testing. It is advisable to select an approach that utilizes a limited number of indicators and analytical tools. Your success in trade is closely tied to your ability to maintain emotional stability and focus.