Are you seeking to trade foreign currency exchange markets yet need more time or expertise to navigate the forex landscape effectively? Forex PAMM accounts present a favorable option for consideration.

How Does a PAMM Account Work?

The Percentage Allocation Management Module (PAMM), alternatively referred to as Percentage Allocation Money Management, represents a collective investment approach employed in forex trading. The investor can allocate their capital in a predetermined ratio to the selected trader(s) or money manager(s) who possess the necessary qualifications.

The individuals in question, namely traders and managers, can oversee and administer numerous forex trading accounts by utilizing their capital and pooled funds, all with the primary objective of generating profitable outcomes.

Let us examine an illustrative example to provide a more comprehensive understanding of PAMM accounts.

Participants in the PAMM Account Configuration

- Forex broker or forex trading firm

- Traders or people in charge of money

- The investor(s)

The investors above, namely James, Harry, and Robert, have expressed a keen interest in pursuing financial gains through forex trading. However, they cannot actively engage in forex trading endeavors due to various constraints such as time limitations or a lack of comprehensive expertise in the field.

They are introducing the esteemed financial professionals Marcus and Mathew, who possess extensive proficiency in money management, specifically in trading and overseeing external funds, akin to the role of a mutual fund manager. It is worth noting that both individuals also possess personal trading capital, further enhancing their comprehensive understanding of the financial landscape.

The forex trading firm has enlisted the services of Marcus and Mathew as money managers tasked with overseeing and managing various investors’ funds. The investors, namely James, Harry, and Robert, have also elected to enter into a contractual agreement known as the Limited Power of Attorney (LPOA).

The essence of the executed contract lies in the investors’ commitment to assume the inherent risk associated with forex trades, whereby they entrust their capital to a selected money manager who will employ the consolidated funds to engage in forex trading according to their trading style and strategy. Additionally, the document specifies the monetary amount or percentage that the manager will deduct as compensation for providing said service.

In the interest of providing a simplified illustration, it is presumed that all three investors have collectively entrusted Marcus with the responsibility of managing their respective monetary allocations to engage in forex trading. Notably, Marcus levies a fee equivalent to 10% of the generated profits as compensation for his services.

The allocation of each investor’s share, expressed as a percentage contribution to the overall pooled PAMM fund amounting to $15,000, is as follows. It is imperative to remember that the cumulative value of all shares within the pool invariably remains constant at either 1 or 100%.

- Harry = $4,000 / $15,000 = 26.67%

- James = 23.33%

- Robert = 16.67%

- Marcus = 33.33%

Assuming the passage of a single trading term, such as a month, it is observed that Marcus has successfully generated a commendable profit of 30% on his investment pool. Consequently, the current value of his collection amounts to $19,500, derived from the initial capital of $15,000, augmented by a profit above $4,500.

The individual in question implements a deduction of 10% from the overall profit, amounting to $450. The residual profit of $4,050 is allocated among the investors in proportion to their respective ownership percentages within the general investment pool.

- Harry = $4,050 * 26.67% = $1,080

- James = $4,050 * 23.33% = $945

- Robert = $4,050 * 16.67% = $675

- Marcus = $4,050 * 33.33% = $1,350

- Total = $19,050

Based on the initial term’s exceptional performance, wherein a substantial 30% return was achieved, all three investors have collectively resolved to extend their engagement with Marcus for an additional time. Harry and James choose to maintain their investment portfolio, consisting of their original capital plus any returns generated. In contrast, Robert decides to liquidate the profits earned, retaining only his initial investment amount of $2,500.

Additionally, James extends a referral to his acquaintance, Pike, encouraging him to participate in the pool. As a result, Pike contributes a substantial amount of $2,625. A new investor, Pam, has recently registered and opted to entrust Marcus with managing her $1,000 investment. The current aggregate trading pool attributed to Marcus amounts to $22,000.

The following breakdown presents the percentage share allocated to each investor:

- Harry = $5,080/22,000 = 23.09%

- James = 20.20%

- Robert = 11.36%

- Marcus = 28.86%

- Pike = 11.93%

- Pam = 4.55%

The individual identified as Marcus has successfully achieved a return of 15% on an investment totaling $22,000, resulting in a monetary gain of $3,300. Subsequently, Marcus withdraws 10% of the sum above, amounting to $330. The remaining profit of $2,970 will be allocated to individual investors based on their respective shares.

- Harry = 23.09% * $2,970 = $685.80

- James = $600.08

- Robert = $337.50

- Marcus = $857.25

- Pike = $354.38

- Pam = $135.00

- Total pooled money in the fund = $24,970

Moving forward, let us consider the scenario where all the investors opt to sustain their investments above for an additional month under the guidance of Marcus, who, regrettably, experiences a decline of 20% in the value of said investments. Consequently, Marcus will not be entitled to a 10% profit share, and each investor’s portion of the pooled investment will experience a reduction of 20%, resulting in a decrease of $4,994, bringing the total pooled funds to $19,976.

- Harry = $5,765.8 – 20% = $4,612.64

- James = $4,036.06

- Robert = $2,270.00

- Marcus = $5,765.80

- Pike = $2,383.50

- Pam = $908.00

- Total pooled PAMM fund for Marcus = $19,976

What Criteria Should Be Considered When Selecting a Money Manager?

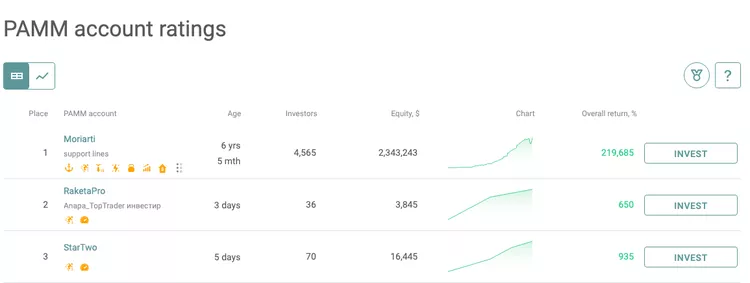

Brokerage firms provide various options to enable investors to make well-informed decisions. These options encompass comprehensive CVs, qualifications, historical performance data in terms of returns, assets under management, number of associated investors, and positive and negative reviews of their traders and money managers. Furthermore, it should be noted that there exist external rating systems. I am attaching a screenshot depicting Alpari’s PAMM account rating system.

Considerations for Investors

- Most investors can only choose forex trading assets from the money manager.

- They risk losing funds owing to money managers’ trading, but if the manager performs well, they can earn profits.

Considerations for Money Managers

- Access their pool money exclusively. They cannot withdraw investor trade funds. For instance, Harry may have $9,000 in his forex trading account but only $4,000 for Marcus. Therefore, Marcus cannot trade beyond that amount.

- Can specify investor minimum and maximum amounts.

- Can approve or reject new investors

Conclusion

PAMM accounts represent a streamlined and convenient avenue through which individuals may select and allocate their financial resources to proficient money managers within the realm of forex trading. Investors can derive advantageous returns while maintaining a limited level of engagement through these particular accounts.

PAMM accounts, despite their potential benefits, are not immune to the inherent risks associated with capital loss, which are contingent upon the performance of the designated money manager. Upon comprehending the individual’s desired profit potential and risk aversion, they must undertake a thorough due diligence process to select a PAMM account broker and money manager meticulously.